칭찬 | Understanding the Best Gold IRA Choices on your Retirement

페이지 정보

작성자 Dylan 작성일25-09-01 09:06 조회7회 댓글0건본문

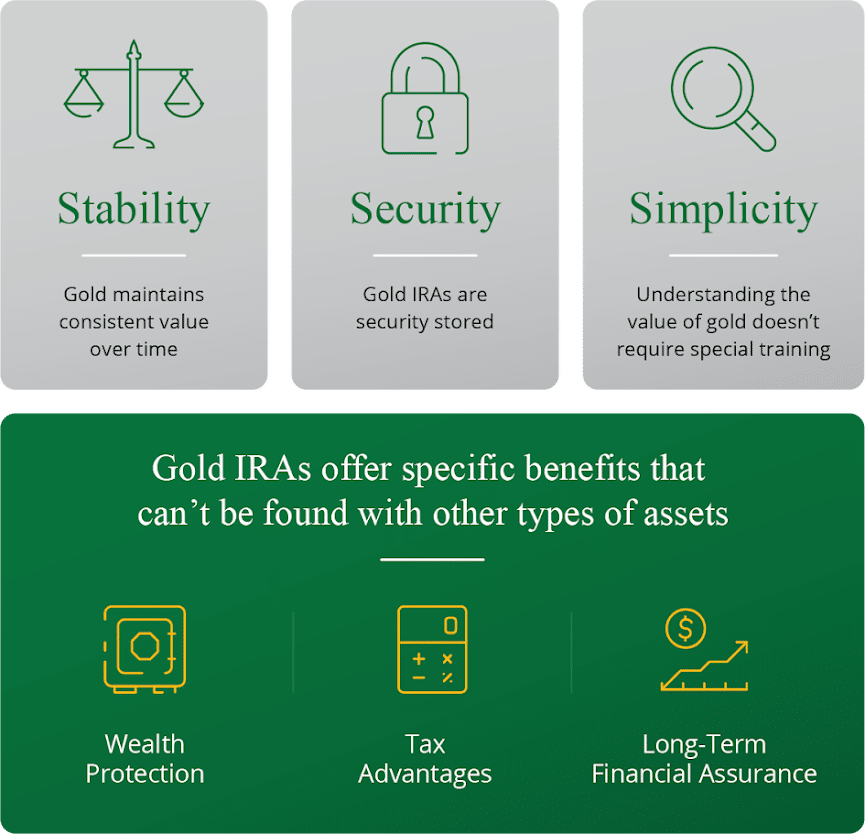

Investing in a Gold IRA (Individual Retirement Account) has become more and more standard amongst individuals in search of to diversify their retirement portfolios and protect their savings against inflation and financial instability. With the rise in demand for valuable metals, particularly gold, it's essential to know how to choose the best Gold IRA on your wants. This text will discover the benefits of Gold IRAs, the elements to contemplate when choosing the right choices, and a few reputable firms to consider in your investment.

What's a Gold IRA?

A Gold IRA is a specialized sort of self-directed individual retirement account that enables traders to carry bodily gold, silver, platinum, and palladium in their retirement portfolio. Not like traditional IRAs, which typically hold paper property like stocks and bonds, a Gold IRA can include tangible assets that have intrinsic worth. This diversification might help protect against market volatility and inflation, making it a lovely option for a lot of buyers.

Benefits of Investing in a Gold IRA

- Inflation Hedge: Gold has traditionally been considered as a hedge against inflation. When the worth of paper currency declines, gold typically retains its value, providing a safeguard to your retirement savings.

- Diversification: Together with gold in your retirement portfolio may help scale back risk. Gold typically behaves differently than stocks and bonds, which suggests it could present a buffer throughout market downturns.

- Tangible Asset: In contrast to stocks and bonds, gold is a bodily asset that you may hold. This tangibility can present peace of thoughts for investors concerned in regards to the stability of financial markets.

- Tax Benefits: Gold IRAs supply the same tax advantages as traditional IRAs. Contributions may be tax-deductible, and the investments grow tax-deferred till you withdraw them in retirement.

- Safety from Financial Uncertainty: In instances of economic turmoil, gold is often seen as a safe haven. Holding gold in your IRA can provide a level of safety in opposition to geopolitical dangers and financial crises.

Factors to think about When Selecting the Best Gold IRA

When selecting a Gold IRA provider, there are several key elements to consider to ensure you make the best choice on your retirement financial savings:

- Status and Credibility: Analysis the fame of the Gold IRA companies you might be considering. Search for evaluations, ratings, and buyer testimonials to gauge their reliability and customer support.

- Charges and Costs: Totally different Gold IRA providers have various payment structures. Be certain to grasp the setup fees, storage fees, and any other fees related to maintaining your account. Low charges can considerably influence your total returns.

- Storage Options: Gold should be stored in an accredited depository to comply with IRS regulations. Be certain that the company you choose offers secure storage options and that you just understand the related costs.

- Funding Options: Check what types of treasured metals the supplier permits of their Gold IRA. Some corporations could provide a wider variety of gold coins and bullion than others.

- Customer Support: Good customer service is essential when coping with retirement accounts. Be sure that the company you select has knowledgeable representatives who can assist you with any questions or considerations.

- Instructional Sources: A reputable Gold IRA supplier should offer academic resources that can assist you understand the funding process. Look for firms that present guides, articles, and other materials to help you make knowledgeable selections.

Top Gold IRA Companies to think about

- Birch Gold Group: Birch Gold Group is nicely-identified for its glorious customer support and instructional assets. They provide a wide range of valuable metals for funding and have a strong status in the industry.

- Augusta Treasured Metals: Augusta is acknowledged for its transparency and dedication to buyer schooling. They supply a wealth of information about gold investments and have a simple charge construction.

- Goldco: Goldco makes a speciality of serving to purchasers roll over existing retirement accounts into Gold IRAs. They've a strong repute and offer quite a lot of reliable precious metals ira accounts metals for funding.

- Noble Gold: Noble Gold stands out for its deal with customer satisfaction and personalized service. They offer a range of investment choices and are known for their academic method.

- American Hartford Gold: This firm offers a user-friendly expertise and a wide collection of gold and different precious metals. If you enjoyed this short article and you would certainly like to receive more information relating to top gold ira companies kindly see our web-page. They also have a strong status for customer service and transparency.

Steps to Open a Gold IRA

- Choose a Gold IRA Supplier: Research and select a reputable Gold IRA company that fits your wants.

- Open Your Account: Full the mandatory paperwork to open your Gold IRA. This sometimes involves providing private data and choosing your preferred investment options.

- Fund Your Account: You possibly can fund your Gold IRA by way of a direct transfer from one other retirement account, a rollover, or a money contribution, relying in your monetary state of affairs.

- Choose Your Precious Metals: Work along with your Gold IRA supplier to decide on the gold or other precious metals you wish to spend money on.

- Storage Association: Your supplier will help you arrange for secure ira investment in gold and silver storage of your valuable metals in an permitted depository.

- Monitor Your Funding: Commonly overview your Gold IRA to ensure it aligns with your retirement objectives and make adjustments as obligatory.

Conclusion

Investing in a Gold IRA is usually a wise determination for those looking to diversify their retirement portfolios and protect their savings from economic uncertainties. By considering components such as status, charges, storage options, and buyer help, you can choose the best gold ira companies for beginners Gold IRA supplier in your wants. With a spread of respected firms available, you'll be able to confidently spend money on precious metals and secure your monetary future. At all times remember to conduct thorough analysis and consult with financial advisors to ensure that a Gold IRA aligns with your total retirement technique.

댓글목록

등록된 댓글이 없습니다.