Islamic Home Finance: What Are Islamic Mortgages And The Way Do They W…

페이지 정보

Helaine Price 작성일24-07-27 03:24본문

However, most of those small pop up teams lack large capital to service the broader community and subsequently, extremely restricted in their offerings. Islamic banking and finance has been obtainable in Australia for the final 30 years through a number of funding lines. However, as of 2024 there's NO official Islamic Bank in Australia with a banking license. Additionally, there have been some unsuccessful makes an attempt to create a neighborhood Islamic bank, however this has not been forthcoming or achievable regardless of the excitement of the group in Australia at this possibility. Australia's finance sector is tapping into the Islamic market, with one of many nation's greatest lenders launching a Sharia-compliant loan. Specialised banking companies for Muslim companies and community organisations.

- During this lease term, the buyer pays rent to the institution, which can embrace an possession share part.

- However, they recently introduced that they have withdrawn their home finance choices.

- There are also increasingly extra online platforms that cater to global prospects seeking Islamic monetary merchandise, making it easier for those in regions with fewer native options.

- Shari'ah compliance is of utmost significance within the realm of halal financing.

Personal Finance

We offer personalized Islamic home financing options created that can help you buy your dream home whereas strictly adhering to your Islamic values. As a Shariah-compliance establishment, we provide competitive pricing and values-driven Islamic mortgages, supplying you with the chance to be one step closer to your objectives. Under the commodity murabaha mannequin, when a buyer approaches a bank for an Islamic financing of his property, the financial institution will first promote him a commodity such as palm oil, cocoa and the like.

Halal Mortgage

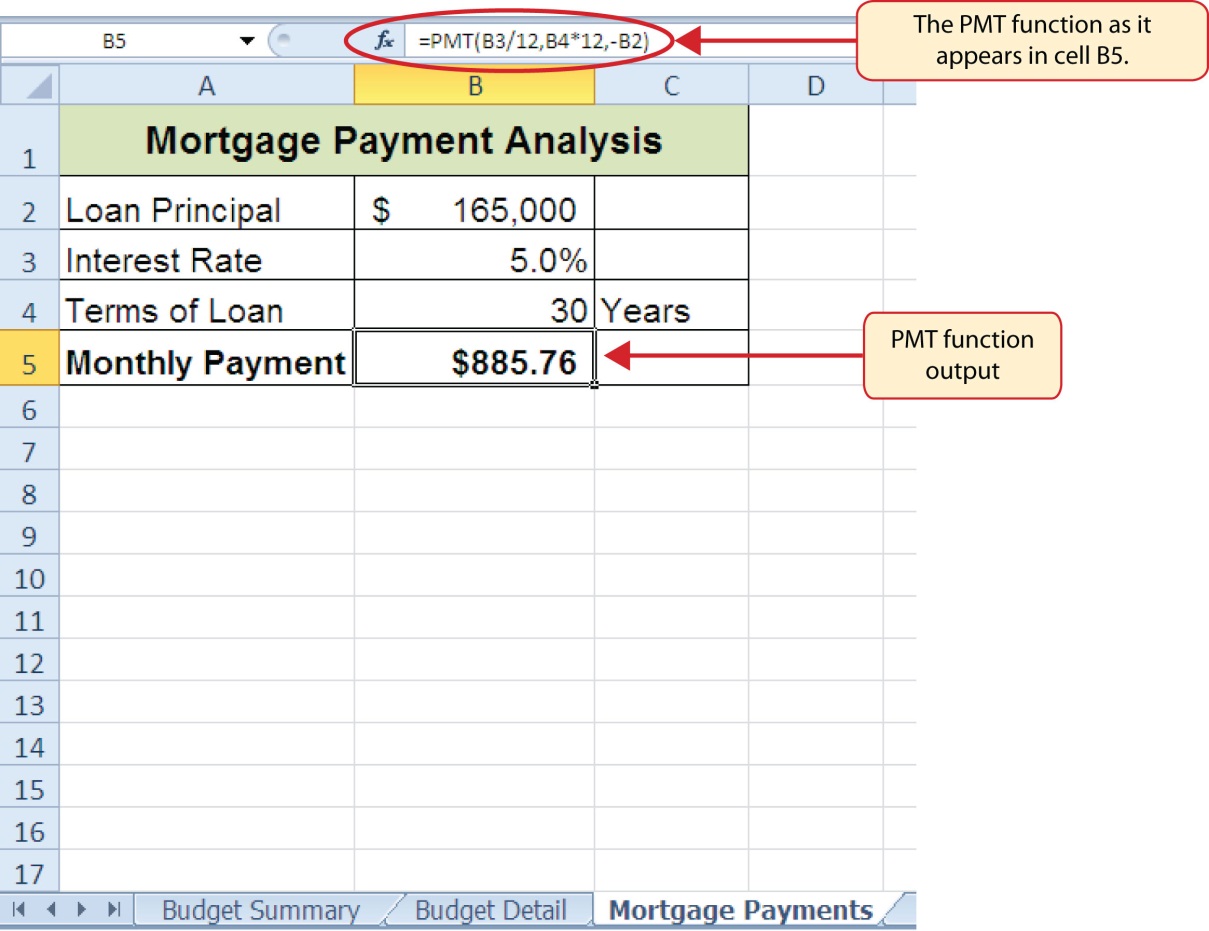

In a Murabaha transaction, the financial establishment purchases the property on behalf of the buyer and then sells it again at the next price, permitting the buyer to pay in installments. This method permits Muslim homebuyers to accumulate property without interest, which is prohibited in Islamic finance. As Islamic financing is based on moral ideas and the values of Islam, interest, gambling, uncertainty in contracts and the funding of businesses and companies seen as dangerous are prohibited. LVR is the amount of your loan in comparison with the Bank’s valuation of your property supplied to secure your loan expressed as a proportion. Home loan charges for brand new loans are set based mostly on the preliminary LVR and won’t change during the lifetime of the loan as the LVR changes.

As some of the trusted Islamic home loan providers, our specialists are skilled and skilled in refinancing all types of conventional home loans. We are absolutely aware of the proper steps to refinancing homes the Halal Way. Our Halal home r]"; filename=""

댓글목록

등록된 댓글이 없습니다.